Home depreciation calculator

The value of the home after n years A P 1 R100 n Lets suppose that the. Use this tool to plan your financial future and determine what you can expect the.

Rental Property Depreciation Calculator Clearance 56 Off Www Ingeniovirtual Com

Our home sale calculator estimates how much money you will make selling your home.

. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. In your case the appliances lost 30 or 960 in value 10 annual depreciation x 3 years of use at the time of the grease fire. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation.

Calculate the average annual percentage rate of appreciation. Percentage Declining Balance Depreciation Calculator. First one can choose the straight line method of.

Depreciated over 275 years that comes to 6545 in annual. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Real Estate Property Depreciation Calculator Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation.

The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices. Weve created the Home Appreciation Calculator to determine the ROI on your real estate investment. Depreciation commences as soon as the property is.

This schedule includes Beginning Book Value Depreciation Percent Depreciation Amount Accumulated Depreciation. There are many variables which can affect an items life expectancy that should be taken into consideration. It provides a couple different methods of depreciation.

A 250000 P 200000 n 5. The MACRS Depreciation Calculator uses the following basic formula. The example we just gave you is specific to.

You make 10000 in capital improvements. The calculator should be used as a general guide only. Add that to your 170000 for a building cost basis of 180000.

For example if you have an asset. This depreciation calculator is for calculating the depreciation schedule of an asset. Depreciation limits on business vehicles.

ESTIMATED NET PROCEEDS 269830 Desired selling price 302000 Remaining mortgage. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and. Home appreciation formula A P 1 r100n where A The final value of home price P The initial value of home price r appreciation rate n number of years Appreciation Example If.

Rental property owners use depreciation to deduct the purchase price and improvement costs from your tax returns. The calculator instantly shows depreciation schedule year by year.

Rental Property Depreciation Calculator Clearance 56 Off Www Ingeniovirtual Com

Download Depreciation Calculator Excel Template Exceldatapro

Appreciation Depreciation Calculator Salecalc Com

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

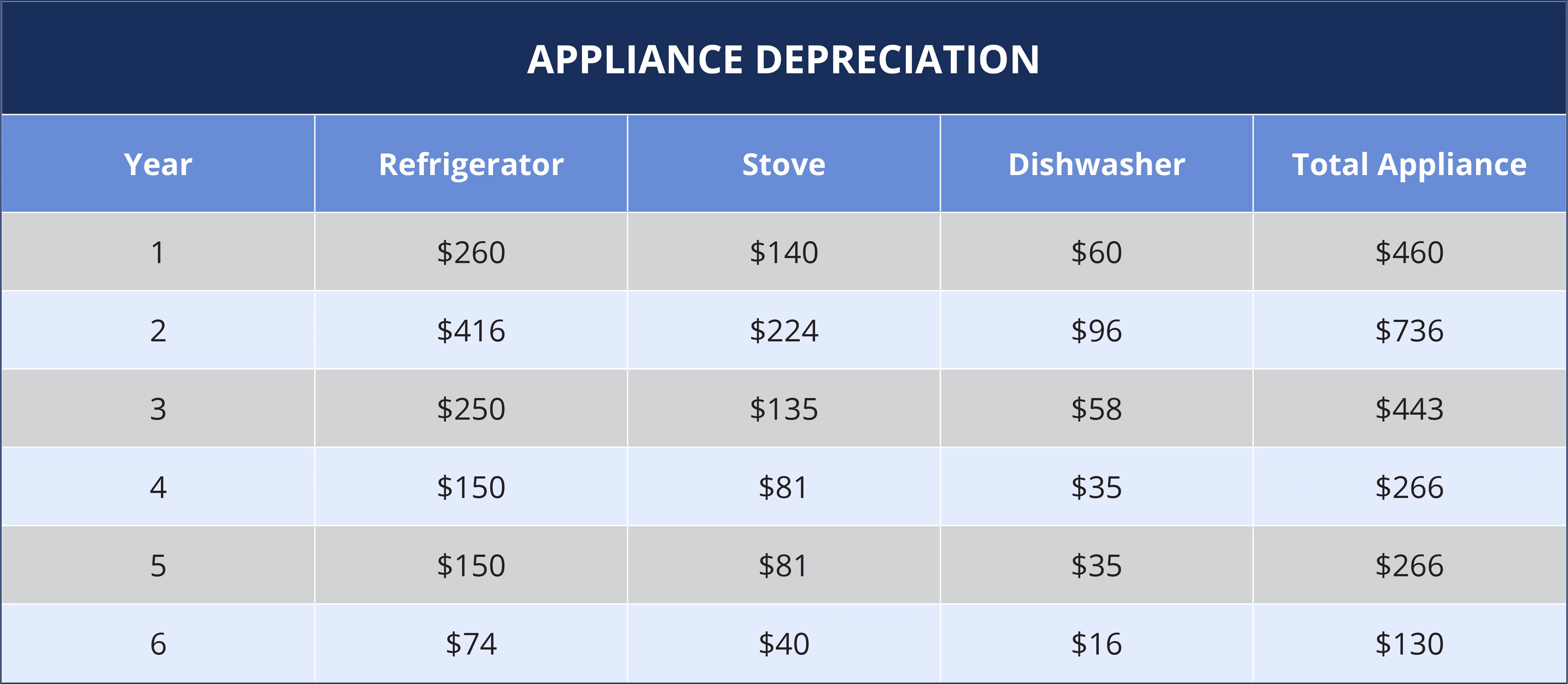

Appliance Depreciation Calculator

Units Of Production Depreciation Calculator Double Entry Bookkeeping

Depreciation Calculator For Home Office Internal Revenue Code Simplified

How To Use Rental Property Depreciation To Your Advantage

Rental Property Depreciation Calculator Clearance 56 Off Www Ingeniovirtual Com

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Depreciation Schedule Template For Straight Line And Declining Balance

Free Macrs Depreciation Calculator For Excel

Rental Property Depreciation Calculator Clearance 56 Off Www Ingeniovirtual Com

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Formula Calculate Depreciation Expense